If you are not signed up for e-statements, these tax forms will be mailed to you:

- 1099 INT

- 1098 Mortgage Interest

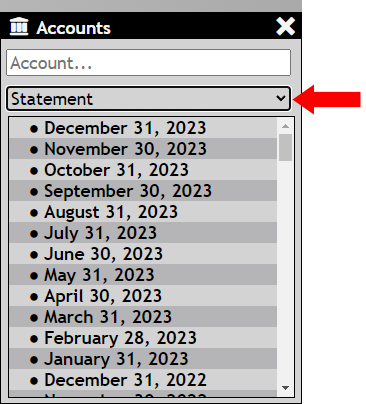

- 1099 R-IRA

- 5498 IRA

- 1099-SA

- 5498-SA

- 1099-Q

- 5498-ESA

If you are signed up for e-statements, follow these steps to access your tax forms:

1. Login to Online Banking

2. Click the E-Statements tab

3. In the Accounts box in the upper right-hand corner of the next screen, click the down arrow:

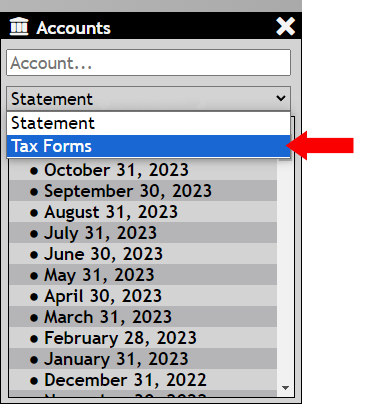

4. Select Tax Forms:

5. Tax forms are then listed by year and can be printed or downloaded by clicking on the form name:

What if there are no forms listed in the drop down menu?

If you did not have reportable tax-related events on your Mid American accounts, then no forms will be listed for that year. Regarding dividends, financial institutions are not required to report dividends or interest earned that totals less than $10 in a given tax-year. If your deposit account earned less than $10 in dividends, then a 1099-INT form was not filed with the IRS. However, you are still required to report any dividends earned as income, even if it was less than $10. You can find dividends earned in a given year on your December statement.